Once logged in you are ready to record transactions....

- The system is based on what we term "Repositories".

A Repository is like a Bank Account in a certain (fiat) currency.

For example, Barclays Bank account holding Pound Sterling, a Bank of America account holding US Dollar or an HSBC Bank Account holding Pound Sterling. These will be akin to three different Repositories.

Although not common in Fiat currency world, in a cryptocurrency world with potentially many coins, tokens and many platforms/accounts, the "Repository" concept is an important method to handle the potential complexity.

Think Repository = Account and you will not go far wrong.

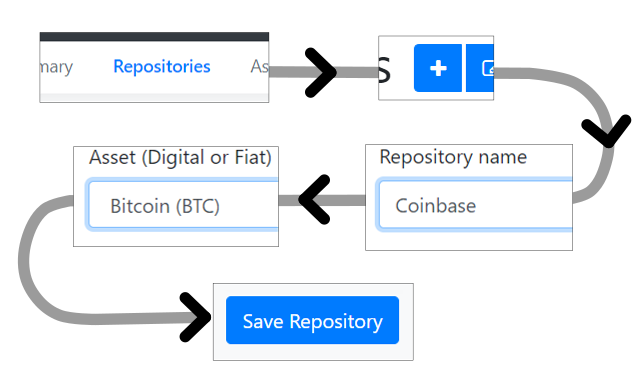

- To start things off, it may be best to add a Repository. So click on "Repositories" menu tab. Then click the "plus" button.

- It is likely your first foray into the crypto world would be a transaction on a platform involving Bitcoin. For example, buying Bitcoin in a platform/website called Coinbase.

- Using this example then, add a Repository, by typing in Coinbase and then select the Asset (currency), which in this case is Bitcoin, then click "Save Repository".

- For this example you will probably need to repeat this process and add another Repository, Coinbase but this time select the Asset (currency) as Pound Sterling, then click "Save Repository".

- Once a Repository is saved, it is locked in system ready to be utilised for additional transaction recording.

- Now you are ready to add some transactions. The more accurate and comprehensive your recording is the better.

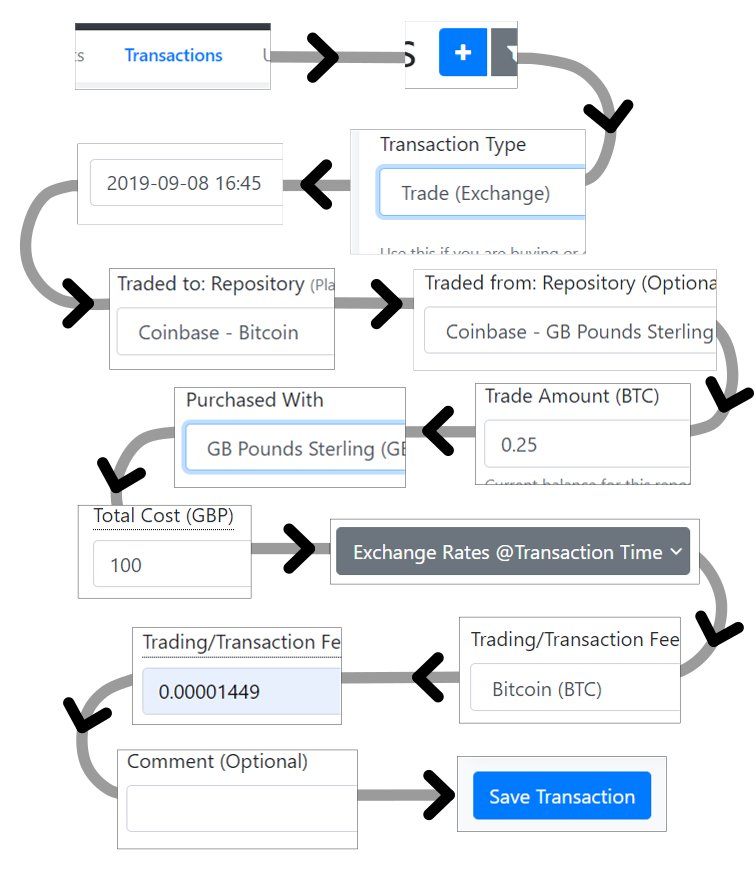

- You need to decide the Transaction Type. Think in terms of Repository, how the currency manifested and where it came from. In the example, Bitcoin was bought directly using Pound Sterling on the Coinbase platform. So Pound Sterling was in reality "Traded" (or exchanged) for Bitcoin in Coinbase.

- Enter date of transaction and as this is a wizard based system that guides, you will select Repository where Bitcoin ends up, or settles or Traded to (Coinbase-Bitcoin) and from where it came from or Traded from (Coinbase-GB Pounds). In this case you had Pounds Sterling residing in Coinbase and you used those funds to trade Bitcoin.

- Now you can specify the amount of Bitcoin was purchased, followed by the amount of Pounds Sterling it cost.

- Note that all this information should be readily available through reports that all platforms provide.

- Reports on different do vary but the information will be recorded. As this system is wizard based, if you do not have all information to hand the system can help fill in some details for you and let you know if mandatory information is missing.

- You will have the option to enter the exact exchange rate that the platform used at time of transaction. Some reports will have this information if you do not have this to hand. However, if you do not it is not an issue as the system will enter this information for you.

- Next you can add the Trading or Transaction fee. Although this is not usually required for Tax purposes (fees are not taxed), for peace of mind and to ensure you have an accurate track of Cryptocurrencies, it is recommended to include this.

- Last but not least we provide you an opportunity to add Comments. This is useful to help locate transactions in future. For example, you may wish to add more information like Transactions numbers etc.

- Then click "Save Transaction"

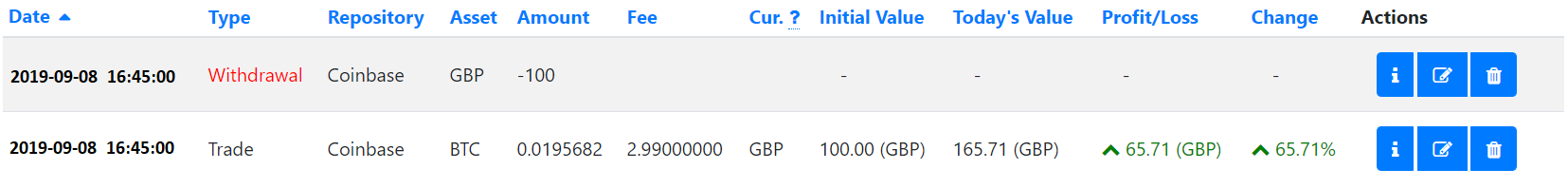

- Under Transactions you will see this record entered into the system. In this particular case where Pounds Sterling was used to buy Bitcoin (or technically Pounds Sterling was traded or exchanged for Bitcoin), two transactions are recorded.

- Note date and time of trade and transaction type. Bitcoin was the trade and the automatically added transaction shows the amount of Pounds Sterling withdrawn from the Coinbase to enact this trade/exchange.

- You will need to do this for every transaction, which for some will be a challenging and laborious process. There are no shortcuts here. The best thing to do is to run and download reports from all the platforms where you have currencies and build a picture of the flow of funds from one platform to another should the need arise.

- Capturing and recording this transaction flow on system will be worth it in the end as it will give you a sense of order and control, whilst leveraging all the features this system can offer to the max.

- Only one example of one type of transaction has been shown here. The system enables you to choose from many different types of transactions and you have the flexibility to satisfy your own needs. As long as the system reflects the same balance as you have in reality, you have not gone far wrong.

- The system allows you to edit existing transactions any time or delete a transaction and re-enter to make it as easy as possible.

- The system is open and flexible to allow you to do whatever tweaks you need or to a large extent allows you to use your own interpretation. As long as your are happy with results and the numbers balance out you will reap the benefits this system affords you.